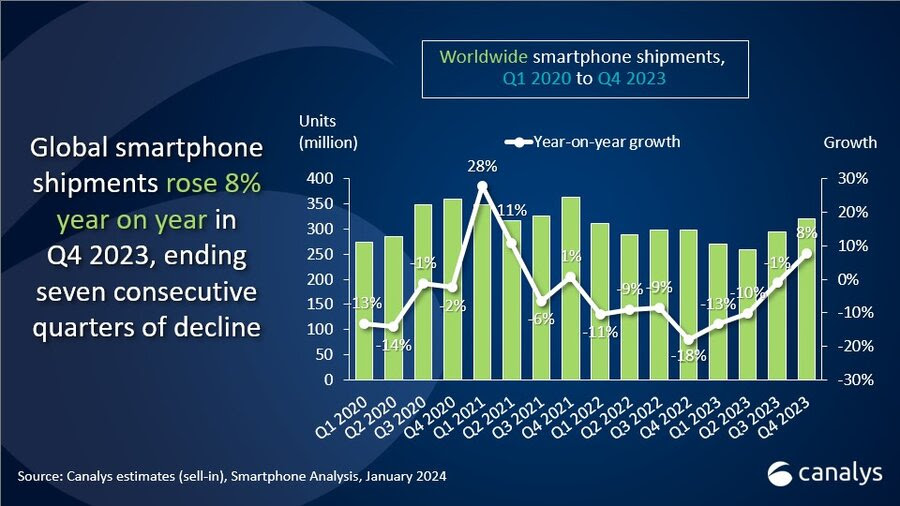

Although Canalys competitor, IDC, said the smartphone market dropped 3.2% during 2023, both Canalys and IDC point to an 8 and 8.5% growth rate in Q4 2023, while both agree that Apple was the top smartphone seller in 2023

According to Canalys’ latest research, worldwide smartphone shipments grew 8% year on year in the fourth quarter of 2023, reaching 320 million units. This ended seven consecutive quarters of decline. Apple led the market in the fourth quarter with a 24% share of shipments, thanks to new iPhone launches. Samsung took second place with 17%. Xiaomi was third, with over 20% year-on-year growth in Q4. TRANSSION rose to fourth place for the first time, benefiting from emerging market recovery. With a 7% market share, vivo completed the top five. For full-year 2023, global smartphone shipments reached 1.1 billion units, a 4% decrease from the previous year. For the first time, Apple pipped Samsung to become the year’s top vendor in terms of shipments, though both rounded to 20% shares. Xiaomi, OPPO and TRANSSION held 13%, 9% and 8% shares, respectively.

Meanwhile, IDC stated: “The last time a company not named Samsung was at the top of the smartphone market was 2010, and for 2023 it is now Apple. A sort of shifting of power at the top of the largest consumer electronics market was driven by an all-time high market share for Apple and a first time at the top. Overall, the global smartphone market remains challenged, but momentum is moving quickly toward recovery.

“According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments declined 3.2% year over year to 1.17 billion units in 2023. While this marks the lowest full-year volume in a decade, driven largely by macroeconomic challenges and elevated inventory early in the year, growth in the second half of the year has cemented the expected recovery for 2024. The fourth quarter (4Q23) saw 8.5% year-over-year growth and 326.1 million shipments, higher than the forecast of 7.3% growth.”

Canalys Senior Analyst Toby Zhu added: ““The market is heading in the right direction, aided by improved holiday season demand,” said . “Products in the mid-to-low-end price range are the growth drivers in this recovery wave, helped by a rebound in demand in emerging markets, such as the Middle East and Africa, Asia Pacific and Latin America. Meanwhile, with inventory pressure and global inflation continuing to ease, vendors can finally focus on product innovation and long-term strategy developments, laying down solid foundations for the year ahead. There have already been plenty of new flagship Android launches taking advantage of the on-device AI trend, from Google Pixel and several Chinese vendors, such as HONOR, OPPO, vivo and Xiaomi.”

On the IDC side of the fence, Nabila Popal, research director with IDC’s Worldwide Tracker team said: “While we saw some strong growth from low-end Android players like Transsion and Xiaomi in the second half of 2023, stemming from rapid growth in emerging markets, the biggest winner is clearly Apple.

“Not only is Apple the only player in the Top 3 to show positive growth annually, but also bags the number 1 spot annually for the first time ever. All this despite facing increased regulatory challenges and renewed competition from Huawei in China, its largest market. Apple’s ongoing success and resilience is in large part due to the increasing trend of premium devices, which now represent over 20% of the market, fueled by aggressive trade-in offers and interest-free financing plans.”

We then heard from Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers, who noted: “The overall shift in ranking at the top of the market further highlights the intensity of competition within the smartphone market,”

“Apple certainly played a part in Samsung’s drop in rank, but the overall Android space is diversifying within itself. Huawei is back and making inroads quickly within China, Brands like OnePlus, Honor, Google, and others are launching very competitive devices in the lower price range of the high end. And foldables and increased discussions around AI capabilities on the smartphone are gaining traction. Overall, the smartphone space is headed towards a very interesting time.”

“The top two players are eagerly looking for new growth drivers for their smartphone businesses as both suffered market share declines in Q4,” said Canalys Research Manager Amber Liu. “In 2023, Samsung focused on the mid-to-high-end segment for profitability but lost share in the low-end segment and also its leading position in the global market. Its 2024 product launches, especially in the high-end segment with a focus on on-device AI (see Canalys blog: “On-device AI and Samsung’s role in the future smart ecosystem race”), will support its rebound as an innovation leader in 2024.”

“On the other hand, Apple showed resilience over the past two years, thanks to solid ongoing demand in the high-end segment. The expanded positioning of its iPhone 15 series has pointed to the future direction of Apple’s portfolio strategy to reach a broader range of consumer segments,” said Liu. “But Huawei’s improving strength and looming local competition in mainland China will challenge Apple to sustain its growth trajectory in mainland China while high-end replacement demand in other major markets, such as North America and Europe, is leveling off. Apple must look to new market growth and ecosystem strength to reinvigorate its iPhone business.”

| Worldwide smartphone market share split Canalys preliminary smartphone market pulse: Q4 2023 | ||||

| Vendor | Q4 2023 market share | Q4 2022 market share | ||

| Apple | 24% | 25% | ||

| Samsung | 17% | 20% | ||

| Xiaomi | 13% | 11% | ||

| TRANSSION | 9% | 6% | ||

| vivo | 7% | 8% | ||

| Others | 30% | 30% | ||

| Preliminary estimates are subject to change on final release Note: percentages may not add up to 100% due to rounding; OPPO includes OnePlus Source: Canalys estimates (sell-in shipments), Smartphone Analysis, January 2024 | ||||